Nov 23, 2017

Line Pay Card: A Cure For Your Lack of Debit Card Woes

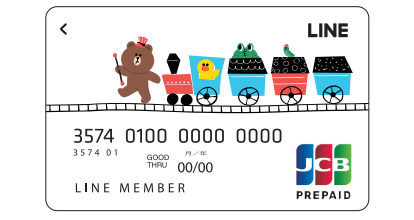

One of the 5 Line Pay Card designs you can choose.

(Line Corporation)

If you’re like most people coming from America, you are probably used to pulling out the plastic whenever buying incidentals like your morning coffee, a candy bar or an order of Chicken McNuggets. That’s because pretty much every bank in the US has some sort of debit card that works on a major credit card company’s network that pulls money directly from your bank account at the time of the sale transaction. These cards may have replaced the traditional ATM only cash card in many places around the word, from Hamburg to Hong Kong, but not here in Japan where cash is still king in many places. The landscape is changing however and many places like convenience stores, fast food chains, and other merchants are accepting them in more places than ever before.

The major sticking point is the lack of debit cards that work with these systems. At the time this article is being put together, only MUFG, SMBC, Rakuten and JapanNet banks seem to have them. Another alternative is to use a reloadable debit card. These are cards that you can load manually with cash either by going to a convenience store, using an ATM, or connecting it to your bank account and transferring money. This at first may seem like more of a hassle rather than the set-it-and-forget-it nature of traditional debit cards, but it actually gives you more control in the long run.

There are many brands of card out there but my #1 pick is the Line Pay card. There’s almost no escaping the reach of LINE, the Made-In-Japan (by way of Korea) instant messenger turned social media network. Literally everyone and their dog uses it, and if you’re in Japan you more than likely using it to communicate to everyone here as well. The app recently debuted its own JCB debit card tied to your Line Pay and Cash account. The beauty of this card is that the management of the whole account lies within your LINE app on your smartphone… Oh, and it’s in ENGLISH as well! One other bonus lies in the fact that you accumulate points as you use the card, just like a regular credit card.

Step 1: Getting the card

First you need a LINE account, and it has to be tied to a Japanese mobile phone number. These are the only requirements, so that also means you can use it for your children and load their pocket money on it. Next, simply navigate into the Line Pay tab in the app and apply for the card. Make sure to pick a cool design!

Step 2: Receiving the card and activation

You should get your new card in the mail in under a week. Activating is dead simple; just use the LINE app to scan the QR code on the letter the card is attached to, and the card is ready for use.

Step 3: Loading the card with money

There are many ways to keep the card topped off with cash, and each method is described in detail within the LINE app _in English_ so you’re never at a loss as to how to do any of them. The simplest method is to head over to a 7-11 ATM, insert the card and feed the machine with some yen notes. Once finished, you should get a message in LINE telling you the new balance and that’s that. Another easy way is to go to Lawson’s and just hand your card to the clerk along with some money and say “charge my card please” (charge in Japan means to put money on the card, not pay for something like elsewhere.)

Instructions for loading the card with cash and paying via the LINE app.

(Line Corporation)

If these options aren’t available, then you can use almost any convenience store’s kiosk or use any bank ATM and the Pay-Easy system, but be sure to read through the instructions in the app first; many of those store and bank systems are only in Japanese but the instructions given on how to use them are pretty thorough. Lastly, you can tie your bank account directly to the Line Pay app itself and then initiate transfers to keep you cashed up. This only works with a limited amount of banks at this point, but the major ones are covered including Japan Post. (If you don’t have a JP account, get one– you can find a post office )

Step 4: Keeping track of it all

It’s easy to tell what’s happening with your account since every transaction shows up in a chat thread between you and the card. If you need help with anything, you can also chat with a customer service representative as well (yay human interaction!).

Step 5: Bonus points!

Everytime you use the card, you get 2% worth the transaction fee in LINE points, which are used as currency for LINE services. Of course you can use them to buy content like stickers and music, but also the points can be use with their shopping and delivery services as well as exchanged for other point systems (Rakuten Points, T-Points, etc), or when tied to a bank account, a cash-back bonus.

Step 6: One more thing…

For the iPhone users out there, this card can’t be used in your Apple Pay Wallet, but it can be used to recharge your Mobile Suica inside the app itself. This is useful for those times when you’re late for your train and don’t have time to manually recharge it, or if you’re already aboard and realize you didn’t have enough money loaded up.

About the author